Satisfied Customers

Amount Disbursed

Loan Disbursed

Years of Experience

From quick personal loans to Insurance, Recharge, and Bill Payments,

Credit4Sure brings financial convenience to your mobile — anytime, anywhere.

Satisfied Customers

Amount Disbursed

Loan Disbursed

Years of Experience

Apply instantly, track easily, and enjoy transparent, paperless, and secure personal loans — designed for your convenience.

Apply online in a few clicks and get approved fast. Credit4Sure ensures quick processing so funds reach your bank quickly — no long waits.

Transparency first. Get your loan with clear pricing — no hidden fees or surprises about interest or repayments.

Simple, visual, and easy to use for everyone. Apply, track, and manage your loan online — no prior experience needed.

100% digital process from start to finish. Upload basic documents online and get approved — smooth and hassle-free.

Your application is securely processed with clear terms — no hidden conditions or extra charges.

Enjoy financial freedom without pledging any security — get a personal loan online with collateral-free availability.

The process of applying for a personal loan through Credit4Sure is fast, simple, and 100% online. Follow these 3 easy steps to get an instant personal loan without collateral directly in your bank account.

Quickly register on the Credit4Sure app by entering your mobile number and verifying it through OTP. This creates your secure loan profile instantly.

Fill in your basic personal and employment details, then complete your digital eKYC for a personal loan using your Aadhaar card for instant verification — no paperwork, no branch visit.

After verification, our instant personal loan approval process begins. Once approved, the loan amount is transferred directly to your bank account — quick, paperless, and without any collateral.

No paperwork. No stress. Just instant personal loans with Credit4Sure.

Check out these easy eligibility criteria to avail an instant personal loan without collateral from Credit4Sure. Apply anywhere, anytime for a personal loan with our quick approval and digital eKYC.

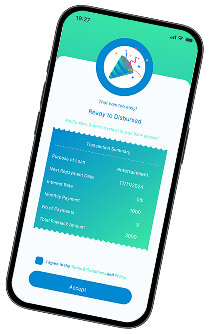

A quick example to help you understand how your Credit4Sure personal loan is calculated, including interest rate, tenure, and total repayment amount.

Mr. Rohan needed an urgent loan of ₹1,00,000 to manage immediate expenses. He applied for a Credit4Sure Personal Loan and got instant approval at an interest rate of 21% per annum for a 36-month tenure.

| Loan Details | Amount / Details |

|---|---|

| Sanctioned Loan Amount | ₹1,00,000 |

| Processing Fee (incl. GST) | ₹3,540 |

| Net Disbursed Amount | ₹96,450 |

| Tenure | 36 Months |

| Interest Rate | 21% per annum |

| Monthly EMI | ₹3,767.50 |

| Total Repayment Amount | ₹1,35,630 |

| Total Cost of Loan (Interest + Fees) | ₹39,170 |

Thousands of happy users trust the Credit4Sure app for instant personal loans with quick approval and 24-hour disbursal. Read real customer feedback and see how Credit4Sure makes getting money fast, simple, and 100% online—anytime you need financial support.

Read expert blogs from Credit4Sure to understand your credit score, discover simple steps to apply for personal loans online, and learn smart ways to build a strong financial future.

Want to know how to boost your CIBIL score or get a personal loan instantly? Explore Credit4Sure blogs for easy guides, expert tips, and everything you need to make confident financial choices.

Ever felt overwhelmed by handling several EMIs every month? The constant juggle of multiple payments and remembering due dates…

Download the app now to apply for an instant personal loan online, pay bills, or recharge your mobile — all in one secure and easy-to-use platform.

Enjoy quick approval, fast disbursal, and a 100% paperless process right from your phone. Download now and get your instant loan today!

Any question or remarks? Just write us a message!

Say something to start a chat!

Get detailed answers to your loan-related queries with Credit4Sure.

Once approved, the loan amount will be disbursed directly to your bank account, usually within a few hours.

Having a good credit history can also improve your chances of instant approval.

No PAN card or physical paperwork is required — the entire process is 100% online and paperless.

Always make sure you’re applying only through the official Credit4Sure website for complete security and confidence.

The approved loan amount depends on your eligibility, repayment capacity, and verification details.

The entire process is 100% online, with instant approval and quick disbursal directly to your bank account.

All details are shared upfront, so you’ll always know the exact cost before applying.

The exact amount depends on your repayment history, credit score, and existing debts. Lenders may also review your employment type and company profile before final approval.

Just complete your Aadhaar-based KYC, upload basic details, and once verified, the amount will be credited to your bank account within minutes or a few hours.

Your loan approval and amount will also depend on your repayment record and overall financial stability.

Mahavira Finlease Limited

info@mahavirafinlease.com

011-42427474 / 84479 14278

193, Patparganj Industrial Area,

Delhi 110092

Mr. Prashant Mishra

(Grievance Officer)

grievance@mahavirafinlease.com

011-42427474

193, Patparganj Industrial Area,

Delhi 110092